Author – CS Gurminder Dhami (Firm- Gurminder Dhami & Associates from New Delhi, IN).

Under Companies Act, 1956 there was no provision governing the resignation tendered by a Director. Thus matters in dispute with respect to mandatory acceptance or approval of resignation were taken to Courts of law, wherein various pronouncements clarifying whether resignation by a Director is a unilateral or bilateral act have been made depending upon the facts & circumstances of the case.

Section 168(1) of the Companies Act, 2013

“168 (1) A director may resign from his office by giving a notice in writing to the company and the Board shall on receipt of such notice take note of the same and the company shall intimate the Registrar in such manner, within such time and in such form as may be prescribed and shall also place the fact of such resignation in the report of directors laid in the immediately following general meeting by the company.

Provided that a director shall (may)[1] also forward a copy of his resignation along with detailed reasons for the resignation to the Registrar within thirty days of resignation in such manner as may be prescribed.

(2) The resignation of a director shall take effect from the date on which the notice is received by the company or the date, if any, specified by the director in the notice, whichever is later.

Provided that the director who has resigned shall be liable even after his resignation for the offences which occurred during his tenure.”

Although, reading of Section 168(1) of the Companies Act, 2013 has made it clear that the resignation by a Director will be effective once served to the Company. But there have been arguments that a Director, who hold posts wherein he is responsible for managing affairs of the Company or assigned with certain roles & responsibilities cannot resign without the approval of the Board.

So, even after enactment of Companies Act, 2013, wherein Section 168(1) expressly provides that resignation by a Director is effective upon service of the same, Can there be situations where the resignation of a Director will be subject to acceptance or approval?

Murari Vs. State of Tamil Nadu (Madras HC) – [1976] 46 COMP. CAS. 613 (MAD.)

“………..If there is any provision in the articles giving right to a director to resign at any time, the resignation will take effect without any need for its acceptance by the board or the company in the general meeting. In the absence of any provision relating to resignation in the articles of association, it is well-settled that a resignation once made takes effect immediately when the intention to resign is made clear.” (Para 13 of the Judgement)

“Even in the absence of any express power to resign, it is submitted that, unless the articles are specially framed, a director may by notice to the company resign his directorship. Directors are merely agents of the company’…., and an agent may determine his agency” (Para 16 of Judgement)

“…………Where a director is elected or has contracted to act for a fixed period, his resignation, before the expiration of the period, may make him liable for damages for breach of his contract, unless the articles permit such resignation.” (Para 18 of the Judgement)

S. Lakshmana Pillai v. Registrar of Companies, Tamil Nadu- [1977] 47 COMP. CAS, 652 (MAD)

“……….Where a resignation states that it is to take effect on acceptance, or the articles so require, acceptance is necessary to end the tenure of office……..” (Para 16 of the Judgement)

“As regards the other contention of the ROC (first respondent) that the Resigning Director (petitioner) should have co-opted another director before he tendered his resignation, I see that there is no obligation under the Companies Act requiring a director, even if he is the only director, to co-opt another in case he intends to resign his office. After going through the provisions of the Act, I find there is nothing to show that such a co-option is a condition precedent for a director validly tendering his resignation. The power of co-option is only an enabling provision to co-opt so as to have the quorum for holding the meeting. There is no specific article in the articles of association of this company that it is imperative; on the part of the outgoing director to co-opt another director before he leaves his office. So this contention also fails.” (Para 28 of the Judgement)

Registrar of Companies, Orissa Vs. Orissa Paper Products Limited (Orissa HC)- [1988] 63 COMP CAS. 460 (ORI.)

“No doubt, resignation of Director does not require acceptance” (Para 12 of the Judgement)

J.S. Gambhir Vs. Millennium Health Institute & Diagnostics Pvt. Ltd. (Delhi HC)- [2014] 120 CLA 372 (Del.)

“…….A resignation by a director implies a relinquishment of his office. This is a unilateral act which unless the Articles of Association otherwise provide, is not contingent on the acceptance by the company. Directors act as agents of the company and are, thus, also entitled to terminate their agency. The act of resignation or relinquishment of the office would not require the consent of the company and, therefore, would become effective from the time when the intention to relinquish the office as a Director is communicated.” (Para 28 of the Judgement)

Rajan Sangameshwaran Vs. Saralaya Technologies Private Limited (Chennai CLB)- [2015] 127 CLA 216 (CLB)

“…………..On the legal aspect it is seen that there is no provision in the Act or in the Regulations contained in Table A regarding the acceptance of resignation of a director by the company, given in the articles of the company there is no requirement of acceptance of resignation by the company”

“………………The only objection of the company in taking note of the resignation of the petitioner and filing Form 32 with the concerned Registrar is that the company incurred certain liabilities at the behest of the petitioner during October 2010 and April 2012……………………..”

“…………….The resignation will not, however, relieve the petitioner from any liability if any, which he may have incurred while in office as alleged by the respondents. I am of the view that the company and its officers made default by not filing Form 32 intimating the resignation of the petitioner from the post of director……………..” (Para 5 of the Judgement)

Manav Kumar Agarwal Vs. Discovery Enterprises Private Limited & Ors.

- Decided by CLB (Delhi CLB)- No. 51/614/CLB/2016, Dtd. 01/03/2016

“On reading this section, it is no doubt true that the Tribunal is vested with powers to direct the company to make good the default in case the company flouted any of the provisions of the Companies Act, 1956. It is a settled proposition of law, whenever company is to file any return, account or other documents, then it has to necessarily pass a Board Resolution to send such document to the Registrar of Companies. Unless the company has passed any resolution, accepting document or return, it can’t be said that the company has committed default in filing of form before the Registrar. Here, the case of the petitioner is that he has given resignation letter to the company on 18.01.2011 but it is not the case of the petitioner that the company passed a resolution and failed to file such resolution copy approving resignation of the petitioner as director before ROC. For there being no Board Resolution accepting the resignation, his mere giving resignation letter will not amount to resolution by the Board. It is needless to say that unless there is a Board Resolution by the company, it shall be presumed that the petitioner has been continuing as director of the company.” (Para 9 of the Judgement)

- Set aside by Hon’ble Delhi High Court & Remitted back to NCLT (Delhi HC)- CO.A(SB) 17/2016 & Co. Appl. No.4814/2016; Dtd. 10/02/2017

“……the CLB was of the view that in absence of Board Resolution accepting the appellant’s resignation, his merely giving a letter of resignation would not suffice and in law, it would be presumed that the appellant continued as a director of the company” (Para 3 of the Judgement)

“……a resignation by a director is a unilateral act and unless otherwise specified in the Articles of Association of a company, a resignation would become effective from the date on which it is communicated” (Para 5 of the Judgement)

“The impugned order is consequently set aside. The matter is remitted back to the CLB (now NCLT) for determination of the underlying dispute de novo, in accordance with law, as expeditiously as possible.” (Para 7 of the Judgement)

- Finally Decided by Hon’ble NCLT (Principal Bench, NCLT, Delhi)-CP-17/2016, Dtd. 18/05/2018

Upon remission of the matter to NCLT for determination of disputes de novo, NCLT Upheld the order passed by the Delhi High Court.

Analysis of the aforesaid Judgements

Upon analysis of the aforesaid judgments if read along with the Section 168, it can be concluded that under the following situations the Resignation by a Director will / will not be subject to approval or acceptance by the Board:-

|

S. No. |

SITUATION |

Whether Resignation will be subject to Approval of Board, if AOA ***

|

|

is silent

|

contains express provision for acceptance of Resignation [2] |

|

1 |

Resignation Letter itself states that it is subject to acceptance by Board |

YES |

YES |

|

2 |

Resignation by Director before expiry of fixed tenure for which he was elected or contracted |

NO[3] |

YES2 |

|

3 |

Resignation by only remaining Director in the Company |

NO[4] |

YES |

|

4 |

Where before the date of resigning by a Director, the Company has incurred many liabilities at the behest of the Director. |

NO |

YES |

|

5 |

Where Company did not pass a resolution to file the e-form 32 / DIR-12 with ROC for intimating the Resignation? |

NO |

YES |

*** According to various judicial pronouncements, the AOA of the Company can make the requirements of the Act more stringent. Therefore, the operation of Section 6 (Act to override MOA/AOA) will not effect the operation of a clause in the AOA that requires acceptance of resignation by a Director, which is contradictory to Section 168 and thus the AOA shall prevail over Section 168.

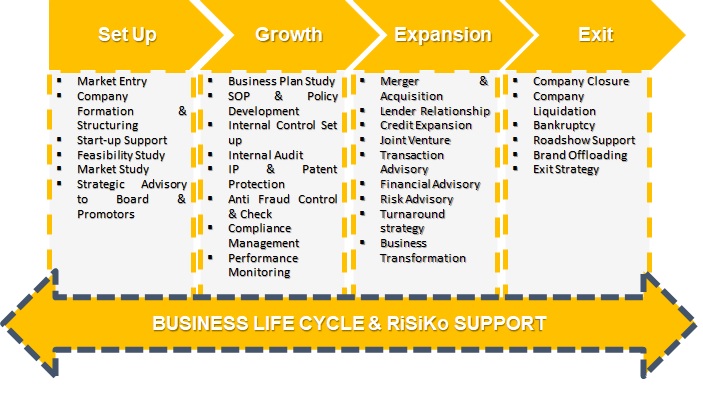

Note of thanks to our Author – RiSiko would like to offer word of thanks to CS Gurminder Dhami (Firm- Gurminder Dhami & Associates from New Delhi, IN) for this valuable contributions on this critical topic. You can reach out to him for any Queries/suggestions or Questions at csgurminderdhami@gmail.com

Disclaimer: The entire contents of this article have been prepared on the basis of relevant provisions, judgements and information existing at the time of preparation. The observations of the author are personal view and the author does not take any responsibility of the same and this cannot be quoted without the written consent of the author.

[1] Substituted by the Companies (Amendment) Act, 2017 and effective from 07/05/2018.

[3] This may make the Director liable for damages for breach of contract.

[4] If the AOA provides that single remaining Director shall not resign before co-opting another Director in his place, then the resignation letter by the Single remaining Director will not be treated as valid resignation, unless he has co-opted another Director.

Online Enquiry

Online Enquiry

Useful Links

Useful Links