Author – CS Gurminder Dhami (Firm- Gurminder Dhami & Associates from New Delhi, IN).

Although the provision w.r.t. resignation of a Director is one of the most lucid provision but in cases of disputes this is the provision in which most of the nitpicking is done. This article focuses on precautions to be taken by a Director while resigning from the Board of a Company.

TEXT OF SECTION 168 AND RULES MADE THEREUNDER

“168 (1) A director may resign from his office by giving a notice in writing to the company and the Board shall on receipt of such notice take note of the same and the company shall intimate the Registrar in such manner, within such time and in such form as may be prescribed and shall also place the fact of such resignation in the report of directors laid in the immediately following general meeting by the company.

Provided that a director shall (MAY)[1] also forward a copy of his resignation along with detailed reasons for the resignation to the Registrar within thirty days of resignation in such manner as may be prescribed.

(2) The resignation of a director shall take effect from the date on which the notice is received by the company or the date, if any, specified by the director in the notice, whichever is later.

Provided that the director who has resigned shall be liable even after his resignation for the offences which occurred during his tenure.”

The relevant text of Companies (Appointment & Qualification of Directors) Rules, 2014 is reproduced hereunder for ready reference:-

“15 The company shall within thirty days from the date of receipt of notice of resignation from a director, intimate the Registrar in Form DIR-12 and post the information on its website, if any.

16 Where a director resigns from his office, he shall (MAY)[2] within a period of 30 days from the date of resignation, forward to the Registrar a copy of his resignation along with reasons for the resignation in Form DIR-11 along with the fee as provided in the Companies (Registration Offices and Fees) Rules, 2014.

Provided that in case a company has already filed Form DIR-12 with the Registrar under rule 15, a foreign director of such company resigning from his office may authorise in writing a practising chartered accountant or cost accountant in practice or company secretary in practice or any other resident director of the company to sign Form DIR-11 and file the same on his behalf intimating the reasons for the resignation.”

Precautions to be taken by the Director while resigning from the Company

There are certain precautions / checkpoints which should be taken care of while resigning from the Board of the Company.

Que. First of all, why precautions are important in the first place?

Ans. Precautions in resigning from the Board of Directors of a Company is important because it is a Director who is responsible for affairs of the Company and also can be held liable for any act, commission or omission which is / would have been his duty to perform or refrain from. A Director is under the definition of officer in default under Companies Act, 2013 which means if a Company commits any default along with the Company, the Director of the Company will also be liable for the same.

Precaution 1 – Can a Director’s Resignation be subject to approval of the Board?

This issue has been examined by the author in a separate article in light of various judgements and the provision of the Act. Both the articles are available in our blog section for readers.

Precaution 2 – Reasons for Resignation

In terms of proviso to Section 168(1), the Director resigning should provide detailed reasons for his / her resignation.

Although, if the sub-section (1) is read along with the proviso its clear that a Company or its Directors cannot claim that since the reasons for resignation are not detailed or sufficient, therefore the resignation of Director is invalid or void. But it would be a non-compliance of Section 168 on the part of resigning Director, if detailed reasons are not provided.

Now, as to what shall constitute a detailed reason for resignation as Director is an area of discretion and subjective to various interpretations.

Most of the resignation letters state the reason as “pre-occupation in other works”. A plain reading of the aforesaid phrase gives an idea that a person is occupied in other areas and would not be able to devote his time in the capacity of Director of the Company. But if critically analysed this reason will not hold good if the resigning is a non-executive Director who does not have day to day involvement in managing the affairs of the Company as the Director was not actively involved in the management.

The ACCA (Association of Chartered Certified Accountants) in its discussion paper on guidance for Directors while resigning from the Board has stated that “It is acceptable if someone is resigning due to reasons of illness, bereavement or other genuine personal difficulties, but we propose that anyone who uses the ‘personal reasons’ excuse should, if they have other listed directorships, be required to explain in the same announcement why these ‘personal reasons’ do not make it necessary to resign from those positions, too.

Similarly, numerous other factors can come into play and therefore whether a reason for resignation mentioned in the resignation letter can be termed as detailed or not would depend upon the facts and circumstances of the case.

Precaution 3 – Date of Resignation

When we talk about the date of Resignation we are talking about 2 (Two) dates, one the date mentioned on the face of the resignation letter (date of signing the letter) and the other is the effective date of resignation.

The effective date of resignation as per law is date of receipt of letter by the Company or such date from which the Director wants the resignation to be effective as mentioned in the letter, whichever is later, unless the resignation was subject to approval or acceptance of the Board (refer precaution 1 above).

Until the resignation has become effective the Director resigning shall be deemed to be a Director and accordingly shall continue be liable for the acts, commissions and omissions of the Company.

Now, if there is a situation where a Director is aware that there are fraudulent acts are going in the Company and he has been raising alarms in this regard too but nothing has been done by the rest of director in this regard, and he has decided to resign from the Company, he should make sure that his resignation should be effective at the earliest point of time possible. For this he should make sure that if he is not writing an effective date in the resignation letter, then the letter should reach the Company at the earliest instance. For modes through which the resignation letter can be sent to the Company and when the same shall be treated as served can be referred to in precaution no. 4 & 5.

Precaution 4 – Mode of Sending the Resignation Letter

In terms of Section 20 of the Companies Act, 2013, if a document[3] is to be served upon the Company it can be either sent by registered post, speed post or courier or by hand delivery at the registered office of the Company or through electronic means as prescribed in rule 35 of Companies (Incorporation) Rules, 2014, which is e-mail & Fax.

As discussed above the resignation letter can be sent by way of registered post, speed post or courier[4] or by hand delivery at the registered office of the Company or also through e-mail/ Fax at the numbers designated by the Company for communication with the Company. In case of sending the resignation letter by post the same shall be deemed to be delivered or served at the time at which the letter would be delivered in the ordinary course of post.

This means if the resignation letter is sent at the corporate office of the Company or any other office other than the registered office then the resignation shall not be deemed to be served upon the Company.

Precaution 5 – To whom the Resignation Letter should be addressed?

In terms of Section 168(1), the Director resigning should send the resignation letter to the Company. Therefore, a person should not leave any scope of doubt should address the letter to the Board of the Company and not a Director of the Company.

Further, the resigning Director should make sure that the resignation letter is delivered to the Company and not to any Director or officer thereof, to avoid leave any room for interpretational issues or litigations.

Further, the resigning Director should ensure that in case he is opting to send the resignation letter through electronic means then the e-mail id/ Fax No. which the Company has designated for sending communications. Further, in case the resignation is being communicated through e-mail it is advisable that in addition to the e-mail id designated for sending communications, the mail should also be sent to the Company Secretary, if any, Chairman and also on the e-mail id mentioned at the Master Data of the Company at MCA portal.

Precaution 6 – Filing of MBP-1 with the Company within 30 days of Resignation

Section 189(2) of the Companies Act, 2013 requires that a Director who is relinquishing his office shall within 30 days thereof, intimate the Company of his concerns and interests i associations in accordance with Section 184(1) (MBP-1). This is not complied with in most of the cases. Although not giving of MBP-1 will not invalidate the resignation tendered but would definitely be a non-compliance on the part of resigning Director.

Precaution 7 – Should the resigning Director file e-form DIR-11?

Companies (Amendment) Act, 2017 has made filing of form DIR-11 by the resigning Director optional on the part of the Director. Now, on basis of what considerations a Director should decide to file or not to file resignation with ROC in DIR-11.

Although now optional, in following situations it is highly advisable to file e-form DIR-11 for intimating the resignation with ROC:-

- where the resigning Director has an apprehension as to that the Company would be using dilatory tactics to file e-form DIR-12.

- where the resigning Director has an apprehension of use of his Digital Signature (DSC) fraudulently for filing any return of the Company with the ROC, so that the DSC of the resigning Director is de-linked from the Company.

- where the time period of 30 days as stipulated has expired and the e-form DIR-12 has not been filed by the Company yet.

- where there was only 1 Director left on the Board of the Company and he also wants to resign, then he should file e-form DIR-11 because, there is no other Director in the Company and he himself cannot affix DSC in e-form DIR-12 for his own resignation.

- After that, the newly appointed Directors (by promoters or central government) under Section 168(3) will file e-form DIR-12 for resignation of previous Director.

Precaution 8 – Mentioning the e-mail ID in the Resignation Letter

In case, the resignation is being sent by any mode (except e-mail), it is advisable that the resignation letter should contain the e-mail id of the resigning Director, so that the Company cannot delay the filing of e-form DIR-12 on the pretext that the e-mail id of the resigning Director was not available.

Precaution 9 – Obtaining the copy of e-form DIR-12 by inspecting the records of the Company online with ROC

It is advisable that, the resigning Director pay fee at the MCA portal and download the copy of e-form DIR-12 filed by the Company for intimating his resignation, so that cross checking can be done as to whether information and documents corroborate or contradict from the viewpoint of resigning Director.

Precaution 10 – Documents to be preserved in this regard

Following documents should preserved by the resigning Director to enable him to defend the challenges of validity of the resignation:-

- Copy of Resignation Letter.

- Proof of service of Resignation Letter to the Company

- (Speed post receipt/ Regd. Post receipt / email copy / Original receiving, if resignation was served by hand)

- Copy of any acknowledgement / communication received from the Company, if any.

- Copy of AOA of the Company, with specific reference to the clause governing the resignation by a Director.

- Copy of e-form DIR-11 filed with ROC, if any.

- Copy of e-form DIR-12 filed by the Company with ROC.

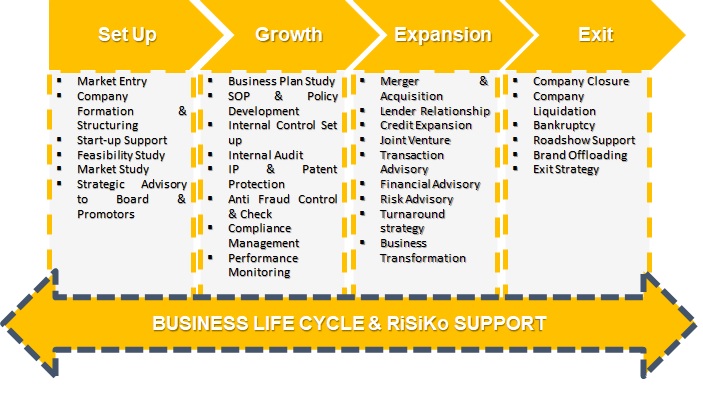

Note of thanks to our Author – RiSiko would like to offer word of thanks to CS Gurminder Dhami (Firm- Gurminder Dhami & Associates from New Delhi, IN) for this valuable contributions on this critical topic. You can reach out to him for any Queries/suggestions or Questions at csgurminderdhami@gmail.com

Disclaimer: The entire contents of this article have been prepared on the basis of relevant provisions, judgements and information existing at the time of preparation. The observations of the author are personal view and the author does not take any responsibility of the same and this cannot be quoted without the written consent of the author.

[1] Substituted by the Companies (Amendment) Act, 2017 and effective from 07/05/2018.

[2] Substituted by The Companies (Appointment and Qualification of Directors) Second Amendment Rules, 2018

[3] As per Section 2(36) Document includes notice and therefore includes “notice in writing” mentioned in Section 168.

[4] Courier means courier which provides a proof of delivery. (Rule 35(5) of Companies (Incorporation) Rules, 2014.

FORMAT of a sample resignation letter can be downloaded from this weblink.

Online Enquiry

Online Enquiry

Useful Links

Useful Links