COVID-19 has profoundly impacted all of us in India and it has specially impacted the Micro, Small and Medium Enterprises and Family Owned Businesses.

Micro, small and medium enterprises (MSME) exporters will be impacted more by the current lockdown on account of Covid-19 pandemic as the sector accounts for over 45 per cent in the country’s total outbound shipments, according to trade experts. Due to lockdown, magnitude of the impact on MSME exporters can be gauged from the statement of the World Trade Organisation (WTO) which has projected that global trade in goods is set to decline steeply between 13 per cent and 32 per cent in 2020 as countries across the world are battling with the Covid-19 pandemic. The MSME sector also contributes about 25 per cent to the country’s GDP (gross domestic product) from service activities and over 33 per cent to the manufacturing output of India. (Source – TOI)

Despite of facing all the hardship, adverse and crisis-situation, we consider MSME is going to be very crucial lifeline in maintaining and re-establishing the disrupted supplies as well as re-starting the wheel of economy.

“We, at RISIKO family deeply understand about this time of crisis as well as upcoming difficult market conditions, especially for our Small Scale Businesses, Family Businesses and MSME community. We pledge to stand firmly with our MSME Sector through our Pro-Bono Consulting Services Schemes. We can assist in providing in devising way-out from any crisis-situation by offering our professional , financial or strategic advisory and by counselling in critical decision-making activities post COVID-19 scenarios. We can further help to explore alternative product/ service solution or strategies for handling the situation effectively and efficiently keeping in mind the associated risk and cost factors.” -Said Vimlesh Chaurasia, founding Partner and CEO of RiSiKo Consulting LLP – India.

To address concerns of small scale businesses, family businesses, start-up, non-profit organisation, entrepreneur and MSME Sector during the COVID-19 pandemic, RISIKO has formed a pro-bono consulting division to specifically help Small Scale & MSME Businesses to survive , revive and navigate through the crisis.

This pro-bono consulting is voluntary act with no cost and with no hidden conditions or charges. We are fully committed to this objective and we are sure, we can make a real difference by helping family, business community, leaders , promoters and entrepreneur.

We value and cherish the contribution of Small Businesses or MSME Sector, and RISIKO would like to repay by offering our Pro-Bono Consulting Services (i.e. Free of Cost Consulting Services) to MSME Sector (Individual or firm or Company etc.).

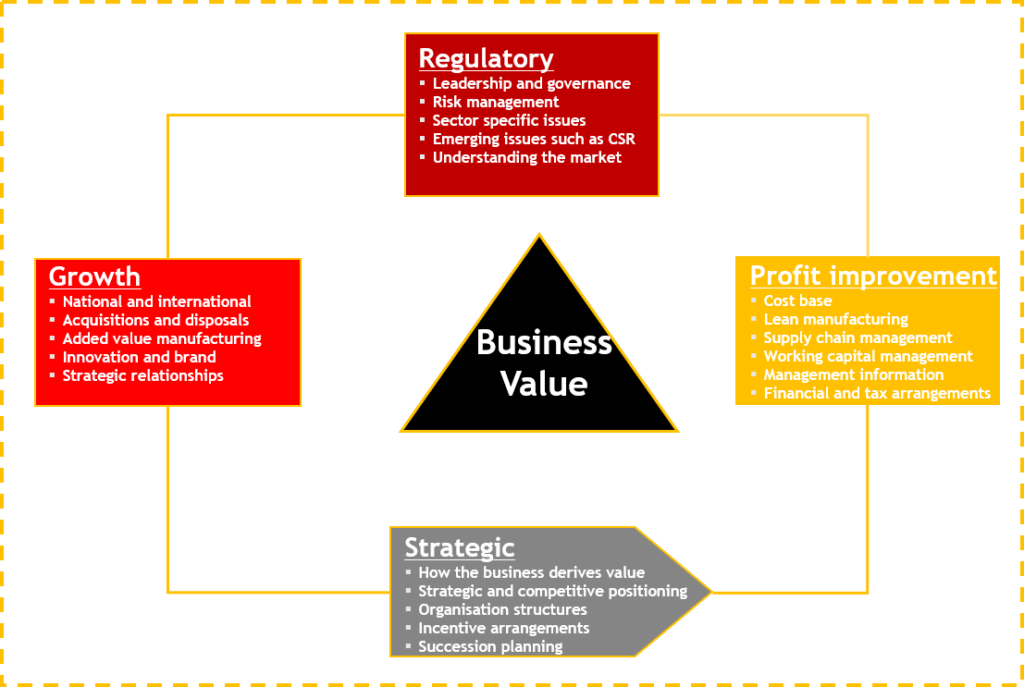

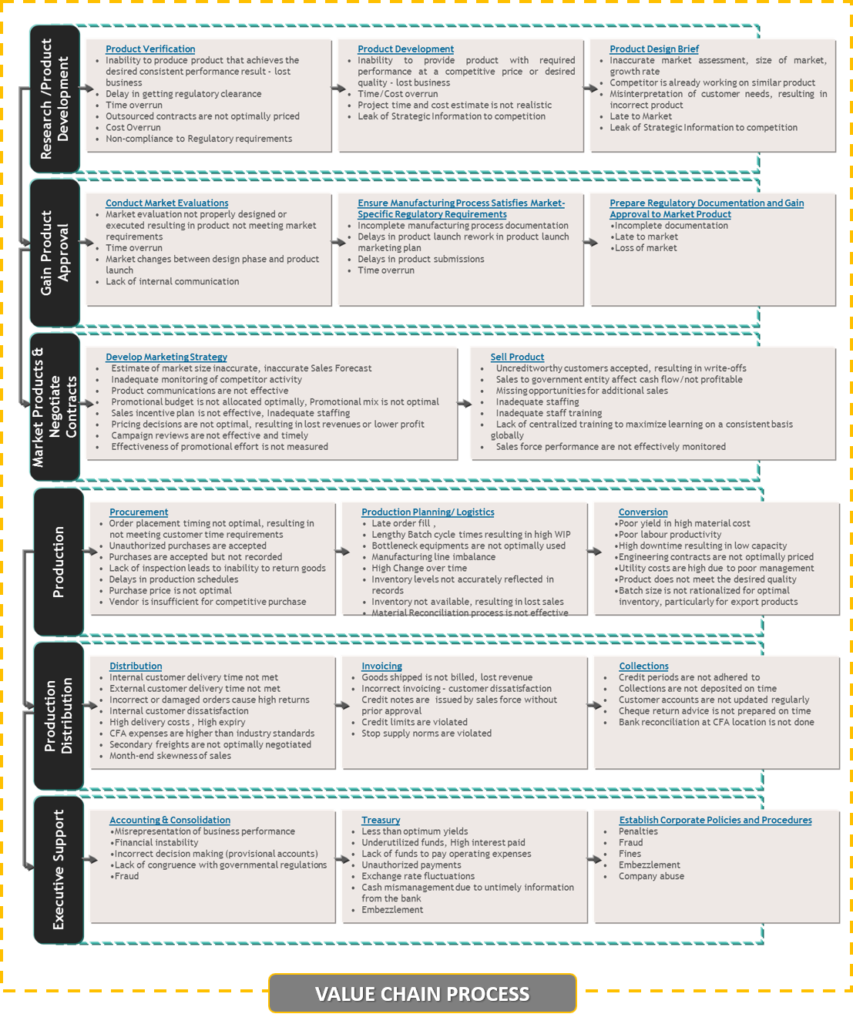

So if you are small scale businesses, family businesses, start-up, non-profit, entrepreneur, MSME Sector and if you have any question or query related to any of the below mentioned areas, you can reach out to us over call or Whatsapp or email or skype : –

- -Income Tax Matters

- -TDS Matters

- -Advance Tax Matters

- -Income Tax Return Matters

- -GST Return Matters

- -GST Refund Matters

- -Contract/Agreement Review and Opinion

- -Dispute Resolution or Negotiation or Settlement

- -Lender Borrower Matters

- -NPA or Loan Default Matters

- -Accounting and Book-keeping

- -Financial Advisory

- -Strategic Advisory

- -Cash Flow Management

- -Cost Control and Cost Reduction

- -CSR Funding and PM Care Donation

- -Turnaround and Crisis Management Strategy (post lockdown -opening)

- -Advisory on new business or license registration

- -New Industry or Factory Set up

- -International Market Entry and Export

- -Import and Export Related matters

- -MEIS & SEIS Related matters

- -Advisory on Government Grant or Financing and Loan options

- -Advisory on Government Economy Stimulant Package for Covid19

- -Reducing the Covid19 impact on Business and Revival Techniques

- -Risk Management and Risk Mitigation Technique

- -Option for Closure or Insolvency or Bankruptcy or Exit Options

- -Discussion or Negotiation with Labour/ Union / Employees/ Staff

- -IT & Technology Automation Tips

- -Any other matters / services listed on our website (www.risikollp.com)

We will continue to provide our Pro-Bono i.e. Free Consulting Services till the end of the June 2020 (& can be extended further,if required) and if you wish to avail Pro-Bono Free Consulting options, please email us your query/ request on [email protected] along with MSME or UAM or Udyog Aadhar ID / Certificate (optional) and your Contract Details.

One of the dedicated Team Member will be assigned to your query and said team member shall get in touch with you within shortest possible time.

Please feel free to reach out to us and give us the opportunity to help the MSME community. For any further questions about this blog , please contact at [email protected]. We again thank you all the Industry and Players in MSME Sector & We Pledge to stand with you always.

Regards and wishing Safety – from RISIKO Consulting Family

Online Enquiry

Online Enquiry

Useful Links

Useful Links